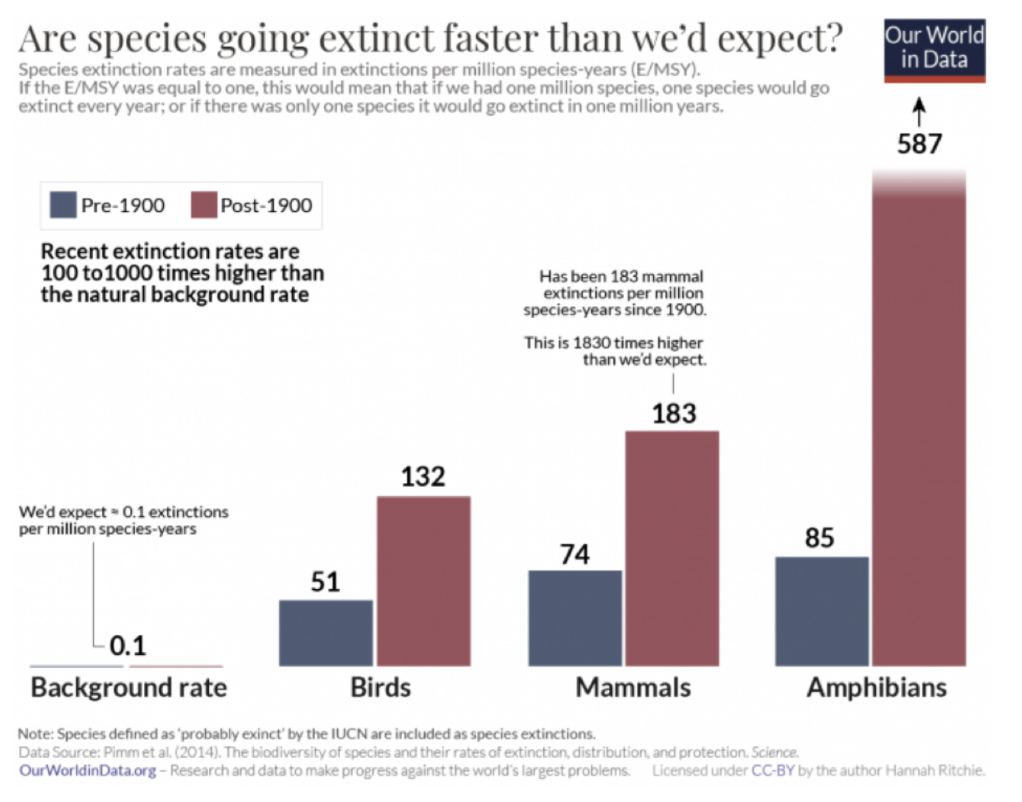

The threat of biodiversity loss is a critical challenge to the future of our planet and economy. Biodiversity, the variety of life in the natural world, is a crucial indicator of the health of our ecosystems. Thriving biodiversity improves the stability and resilience of our ecosystems. Conversely, biodiversity loss threatens vital aspects of a healthy planet and economy, such as food supply, clean water, and a habitable climate. At present, our planet is amid an unprecedented loss of biodiversity, with current extinction rates tens to hundreds of times higher than expected under normal conditions.

For this reason, biodiversity has rapidly emerged as a critical ESG topic for companies to manage. There is a growing recognition that biodiversity loss is tightly linked to climate change and that one issue cannot be solved without addressing the other. Per the World Economic Forum’s 2023 Global Risks Report, biodiversity loss ranks alongside climate action failure and extreme weather as the world’s most severe risks over the next decade.

Biodiversity in the extractives industry

While this topic is an emerging economic issue, managing biodiversity impacts is not new to the mining and extractives industry. Managing the effects of extractive operations on biodiversity has long been a critical concern of community stakeholders. As a result, extractive companies are accustomed to considering biodiversity impacts as part of permitting and, more broadly, to obtain social license for ongoing operations. To help organizations manage biodiversity impacts and concerns, industry groups like the International Council on Mining and Metals (ICMM) and the Mining Association of Canada (MAC) have provided guidance and practice standards for biodiversity management for many years.

However, while this gives the industry a head start — much like the topic of climate change, stakeholder expectations are expected to rise quickly. Communities, markets, and investors will increasingly demand more from how companies measure, manage, and disclose their biodiversity impacts. It is critical to become familiar with the rapidly changing landscape concerning frameworks to address targets, disclosure and reporting.

Kunming-Montreal Global Biodiversity Framework

The Kunming-Montreal Global Biodiversity Framework (GBF) is the most significant framework focused on biodiversity loss and restoration. The GBF resulted from the Conference of the Parties to the Convention on Biological Diversity (COP15) in Montreal in 2022. The Framework was developed in response to growing evidence that biodiversity loss is accelerating at a speed requiring action beyond the commitments that are currently in place. The purpose of the GBF is to catalyze transformative action and garner global support to stop significant loss of biodiversity and begin to reverse the deterioration process.

- GBF contains 23 global targets to be achieved by 2030. The 2030 targets aim to enable the achievement of the longer-term, outcome-oriented 2050 goals set by the GBF. The 23 targets aim to reduce threats to biodiversity, meet people’s needs through sustainable use and benefit-sharing and enable tools and solutions for implementation and mainstreaming.

Emerging guidance

As companies, investors, and lenders look for guidance on accounting for nature-related risks and opportunities, there has been significant momentum in developing biodiversity frameworks and guidelines. Taskforce on Nature-related Financial Disclosure

The Taskforce on Nature-related Financial Disclosures (TNFD) is a global initiative that builds on the model developed by the Taskforce on Climate-Related Financial Disclosures (TCFD). The TNFD was established in 2021 in response to the need to factor nature into financial and business decisions. Its mission is to provide a framework for how organizations can address environmental risks and opportunities, including biodiversity, to shift global financial flows away from nature-negative outcomes and toward nature-positive outcomes.

After two years of public consultation, in September 2023, the TNFD framework published Recommendations for organizations to report and act on nature-related risks. The TNFD Recommendations replicate the 11 Recommendations of the TCFD with nature-related disclosures and add three new recommendations that were not captured in the TCFD.

A unique feature of the TNFD framework unavailable under TCFD is LEAP — essentially a “how to” guide to support organizations in nature-related risk and opportunity assessments.

- Locate your interface with nature; approach

- Evaluate your dependencies and impacts;

- Assess your risks and opportunities, and

- Prepare to respond to nature-related risks and opportunities and report.

LEAP aims to inform strategy, governance, capital allocation, and risk management decisions, including disclosure decisions consistent with the TNFD’s draft disclosure recommendations.

Science-based Targets for Nature

In May 2023, the Science-based Targets Network (SBTN) released the Science-based Targets for Nature (SBT), which are built upon previously established climate targets, the Science-based Targets Initiative (SBTi). Science-based Targets are “measurable, actionable and time-bound objectives based on the best available science that allow actors to align with Earth’s limits and societal sustainability goals.”

The SBTN’s five core steps to set SBTs include:

- Assess

- Interpret and prioritize

- Measure

- Set and disclose targets

- Act

- Track

The SBTN is one of the TNFD’s trusted knowledge partners, and the two organizations are working closely to ensure alignment in helping businesses incorporate nature into decision-making. The SBT and the TNFD have collaborated to develop joint guidance for target-setting within the TNFD framework.

Corporate Sustainability Reporting Directive (CSRD)

The Corporate Sustainability Reporting Directive (CSRD) is a directive that the EU Commission adopted. Through the EU Green Deal, the CSRD replaced the Non-Financial Reporting Directive (NFRD) and expanded sustainability reporting requirements. The European Financial Reporting Advisory Group (EFRAG) drafted the European Sustainability Reporting Standards (ESRS). Unlike the other reporting frameworks discussed, the CSRD is legislative and requires compliance for qualified companies. The first CSRD reporting will be required for companies already subject to the NFRD and those that satisfy specific criteria for fiscal year 2024.

The EFRAG has noted that it did use the TNFD framework and draft recommendations as key inputs into its framework.

Looking Ahead

With attention and guidance on the topic of biodiversity emerging quickly, companies have an opportunity to be proactive on this issue. We recommend getting started by understanding the risks and opportunities biodiversity loss presents to your business to help focus efforts. Using guidance like the TNFD and building solid governance structures will help to develop processes to assess and manage key impacts and exposures.

Resources

Taskforce on Nature-Related Financial Disclosures

- The TNFD is a global, market-led initiative with the mission to develop and deliver a risk management and disclosure framework for organizations to report and act on evolving nature-related risks.

- https://framework.tnfd.global/

World Economic Forum 2022 Global Risk Report

- An annual publication of top risks facing the global economy. Biodiversity loss is ranked #3 in its list of top 10 most severe risks on a global scale over the next 10 years.

- https://www3.weforum.org/docs/WEF_Global_Risks_Report_2023.pdf

Mining Association of Canada’s Biodiversity Conservation Management Protocol

- MAC’s Toward Sustainable Mining biodiversity protocol provides guidance for mining facilities to manage biodiversity impacts.

- https://mining.ca/towards-sustainable-mining/protocols-frameworks/biodiversity-conservation-management/